Using statistics¶

Anaconda Enterprise supports statistical work using the R language and Python libraries such as NumPy, SciPy, Pandas, Statsmodels, and scikit-learn.

The following Jupyter notebook Python examples show how to use these libraries to calculate correlations, distributions, regressions, and principal component analysis.

These examples also include plots produced with the libraries seaborn and Matplotlib.

We thank these sites, from whom we have adapted some code:

Start by importing necessary libraries and functions, including Pandas, SciPy, scikit-learn, Statsmodels, seaborn, and Matplotlib.

This code imports load_boston to provide the Boston housing dataset from the

datasets included with scikit-learn.

import pandas as pd

import seaborn as sns

from scipy.stats import pearsonr

from sklearn.datasets import load_boston

from sklearn.linear_model import LinearRegression

from sklearn.metrics import mean_squared_error

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import StandardScaler

from sklearn.decomposition import PCA

import matplotlib.pyplot as plt

from mpl_toolkits.mplot3d import Axes3D

import statsmodels.formula.api as sm

%matplotlib inline

Load the Boston housing data into a Pandas DataFrame:

#Load dataset and convert it to a Pandas dataframe

boston = load_boston()

df = pd.DataFrame(boston.data, columns=boston.feature_names)

df['target'] = boston.target

In the Boston housing dataset, the target variable is MEDV, the median home value.

Print the dataset description:

#Description of the dataset

print(boston.DESCR)

Boston House Prices dataset

===========================

Notes

------

Data Set Characteristics:

:Number of Instances: 506

:Number of Attributes: 13 numeric/categorical predictive

:Median Value (attribute 14) is usually the target

:Attribute Information (in order):

- CRIM per capita crime rate by town

- ZN proportion of residential land zoned for lots over 25,000 sq.ft.

- INDUS proportion of non-retail business acres per town

- CHAS Charles River dummy variable (= 1 if tract bounds river; 0 otherwise)

- NOX nitric oxides concentration (parts per 10 million)

- RM average number of rooms per dwelling

- AGE proportion of owner-occupied units built prior to 1940

- DIS weighted distances to five Boston employment centres

- RAD index of accessibility to radial highways

- TAX full-value property-tax rate per $10,000

- PTRATIO pupil-teacher ratio by town

- B 1000(Bk - 0.63)^2 where Bk is the proportion of blacks by town

- LSTAT % lower status of the population

- MEDV Median value of owner-occupied homes in $1000's

:Missing Attribute Values: None

:Creator: Harrison, D. and Rubinfeld, D.L.

This is a copy of UCI ML housing dataset.

http://archive.ics.uci.edu/ml/datasets/Housing

This dataset was taken from the StatLib library which is maintained at Carnegie Mellon University.

The Boston house-price data of Harrison, D. and Rubinfeld, D.L. 'Hedonic

prices and the demand for clean air', J. Environ. Economics & Management,

vol.5, 81-102, 1978. Used in Belsley, Kuh & Welsch, 'Regression diagnostics

...', Wiley, 1980. N.B. Various transformations are used in the table on

pages 244-261 of the latter.

The Boston house-price data has been used in many machine learning papers that address regression

problems.

**References**

- Belsley, Kuh & Welsch, 'Regression diagnostics: Identifying Influential Data and Sources of Collinearity', Wiley, 1980. 244-261.

- Quinlan,R. (1993). Combining Instance-Based and Model-Based Learning. In Proceedings on the Tenth International Conference of Machine Learning, 236-243, University of Massachusetts, Amherst. Morgan Kaufmann.

- many more! (see http://archive.ics.uci.edu/ml/datasets/Housing)

Show the first five records of the dataset:

#Check the first five records

df.head()

row CRIM ZN INDUS CHAS NOX RM AGE DIS RAD TAX PTRATIO B LSTAT target

=== ======= ==== ===== ==== ===== ===== ==== ====== === ===== ======= ====== ===== ======

0 0.00632 18.0 2.31 0.0 0.538 6.575 65.2 4.0900 1.0 296.0 15.3 396.90 4.98 24.0

1 0.02731 0.0 7.07 0.0 0.469 6.421 78.9 4.9671 2.0 242.0 17.8 396.90 9.14 21.6

2 0.02729 0.0 7.07 0.0 0.469 7.185 61.1 4.9671 2.0 242.0 17.8 392.83 4.03 34.7

3 0.03237 0.0 2.18 0.0 0.458 6.998 45.8 6.0622 3.0 222.0 18.7 394.63 2.94 33.4

4 0.06905 0.0 2.18 0.0 0.458 7.147 54.2 6.0622 3.0 222.0 18.7 396.90 5.33 36.2

Show summary statistics for each variable: count, mean, standard deviation, minimum, 25th 50th and 75th percentiles, and maximum.

#Descriptions of each variable

df.describe()

stat CRIM ZN INDUS CHAS NOX RM AGE DIS RAD TAX PTRATIO B LSTAT target

===== ========== ========== ========== ========== ========== ========== ========== ========== ========== ========== ========== ========== ========== ==========

count 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000 506.000000

mean 3.593761 11.363636 11.136779 0.069170 0.554695 6.284634 68.574901 3.795043 9.549407 408.237154 18.455534 356.674032 12.653063 22.532806

std 8.596783 23.322453 6.860353 0.253994 0.115878 0.702617 28.148861 2.105710 8.707259 168.537116 2.164946 91.294864 7.141062 9.197104

min 0.006320 0.000000 0.460000 0.000000 0.385000 3.561000 2.900000 1.129600 1.000000 187.000000 12.600000 0.320000 1.730000 5.000000

25% 0.082045 0.000000 5.190000 0.000000 0.449000 5.885500 45.025000 2.100175 4.000000 279.000000 17.400000 375.377500 6.950000 17.025000

50% 0.256510 0.000000 9.690000 0.000000 0.538000 6.208500 77.500000 3.207450 5.000000 330.000000 19.050000 391.440000 11.360000 21.200000

75% 3.647423 12.500000 18.100000 0.000000 0.624000 6.623500 94.075000 5.188425 24.000000 666.000000 20.200000 396.225000 16.955000 25.000000

max 88.976200 100.000000 27.740000 1.000000 0.871000 8.780000 100.000000 12.126500 24.000000 711.000000 22.000000 396.900000 37.970000 50.000000

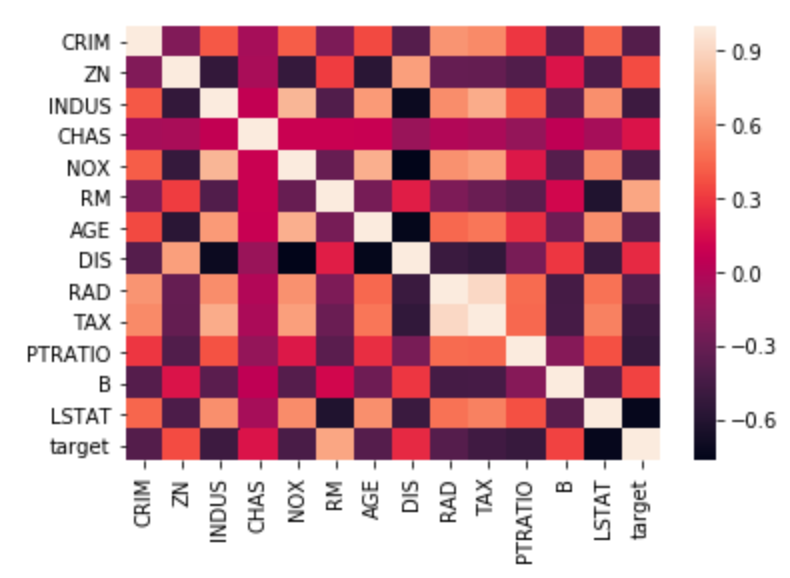

Correlation matrix¶

The correlation matrix lists the correlation of each variable with each other variable.

Positive correlations mean one variable tends to be high when the other is high, and negative correlations mean one variable tends to be high when the other is low.

Correlations close to zero are weak and cause a variable to have less influence in the model, and correlations close to one or negative one are strong and cause a variable to have more influence in the model.

#Here shows the basic correlation matrix

corr = df.corr()

corr

variable CRIM ZN INDUS CHAS NOX RM AGE DIS RAD TAX PTRATIO B LSTAT target

======== ========= ========= ========= ========= ========= ========= ========= ========= ========= ========= ========= ========= ========= =========

CRIM 1.000000 -0.199458 0.404471 -0.055295 0.417521 -0.219940 0.350784 -0.377904 0.622029 0.579564 0.288250 -0.377365 0.452220 -0.385832

ZN -0.199458 1.000000 -0.533828 -0.042697 -0.516604 0.311991 -0.569537 0.664408 -0.311948 -0.314563 -0.391679 0.175520 -0.412995 0.360445

INDUS 0.404471 -0.533828 1.000000 0.062938 0.763651 -0.391676 0.644779 -0.708027 0.595129 0.720760 0.383248 -0.356977 0.603800 -0.483725

CHAS -0.055295 -0.042697 0.062938 1.000000 0.091203 0.091251 0.086518 -0.099176 -0.007368 -0.035587 -0.121515 0.048788 -0.053929 0.175260

NOX 0.417521 -0.516604 0.763651 0.091203 1.000000 -0.302188 0.731470 -0.769230 0.611441 0.668023 0.188933 -0.380051 0.590879 -0.427321

RM -0.219940 0.311991 -0.391676 0.091251 -0.302188 1.000000 -0.240265 0.205246 -0.209847 -0.292048 -0.355501 0.128069 -0.613808 0.695360

AGE 0.350784 -0.569537 0.644779 0.086518 0.731470 -0.240265 1.000000 -0.747881 0.456022 0.506456 0.261515 -0.273534 0.602339 -0.376955

DIS -0.377904 0.664408 -0.708027 -0.099176 -0.769230 0.205246 -0.747881 1.000000 -0.494588 -0.534432 -0.232471 0.291512 -0.496996 0.249929

RAD 0.622029 -0.311948 0.595129 -0.007368 0.611441 -0.209847 0.456022 -0.494588 1.000000 0.910228 0.464741 -0.444413 0.488676 -0.381626

TAX 0.579564 -0.314563 0.720760 -0.035587 0.668023 -0.292048 0.506456 -0.534432 0.910228 1.000000 0.460853 -0.441808 0.543993 -0.468536

PTRATIO 0.288250 -0.391679 0.383248 -0.121515 0.188933 -0.355501 0.261515 -0.232471 0.464741 0.460853 1.000000 -0.177383 0.374044 -0.507787

B -0.377365 0.175520 -0.356977 0.048788 -0.380051 0.128069 -0.273534 0.291512 -0.444413 -0.441808 -0.177383 1.000000 -0.366087 0.333461

LSTAT 0.452220 -0.412995 0.603800 -0.053929 0.590879 -0.613808 0.602339 -0.496996 0.488676 0.543993 0.374044 -0.366087 1.000000 -0.737663

target -0.385832 0.360445 -0.483725 0.175260 -0.427321 0.695360 -0.376955 0.249929 -0.381626 -0.468536 -0.507787 0.333461 -0.737663 1.000000

Format with asterisks¶

Format the correlation matrix by rounding the numbers to two decimal places and adding asterisks to denote statistical significance:

def calculate_pvalues(df):

df = df.select_dtypes(include=['number'])

pairs = pd.MultiIndex.from_product([df.columns, df.columns])

pvalues = [pearsonr(df[a], df[b])[1] for a, b in pairs]

pvalues = pd.Series(pvalues, index=pairs).unstack().round(4)

return pvalues

# code adapted from https://stackoverflow.com/questions/25571882/pandas-columns-correlation-with-statistical-significance/49040342

def correlation_matrix(df,columns):

rho = df[columns].corr()

pval = calculate_pvalues(df[columns])

# create three masks

r0 = rho.applymap(lambda x: '{:.2f}'.format(x))

r1 = rho.applymap(lambda x: '{:.2f}*'.format(x))

r2 = rho.applymap(lambda x: '{:.2f}**'.format(x))

r3 = rho.applymap(lambda x: '{:.2f}***'.format(x))

# apply marks

rho = rho.mask(pval>0.01,r0)

rho = rho.mask(pval<=0.1,r1)

rho = rho.mask(pval<=0.05,r2)

rho = rho.mask(pval<=0.01,r3)

return rho

columns = df.columns

correlation_matrix(df,columns)

variable CRIM ZN INDUS CHAS NOX RM AGE DIS RAD TAX PTRATIO B LSTAT target

======== ======== ======== ======== ======== ======== ======== ======== ======== ======== ======== ======== ======== ======== ========

CRIM 1.00*** -0.20*** 0.40*** -0.06 0.42*** -0.22*** 0.35*** -0.38*** 0.62*** 0.58*** 0.29*** -0.38*** 0.45*** -0.39***

ZN -0.20*** 1.00*** -0.53*** -0.04 -0.52*** 0.31*** -0.57*** 0.66*** -0.31*** -0.31*** -0.39*** 0.18*** -0.41*** 0.36***

INDUS 0.40*** -0.53*** 1.00*** 0.06 0.76*** -0.39*** 0.64*** -0.71*** 0.60*** 0.72*** 0.38*** -0.36*** 0.60*** -0.48***

CHAS -0.06 -0.04 0.06 1.00*** 0.09** 0.09** 0.09* -0.10** -0.01 -0.04 -0.12*** 0.05 -0.05 0.18***

NOX 0.42*** -0.52*** 0.76*** 0.09** 1.00*** -0.30*** 0.73*** -0.77*** 0.61*** 0.67*** 0.19*** -0.38*** 0.59*** -0.43***

RM -0.22*** 0.31*** -0.39*** 0.09** -0.30*** 1.00*** -0.24*** 0.21*** -0.21*** -0.29*** -0.36*** 0.13*** -0.61*** 0.70***

AGE 0.35*** -0.57*** 0.64*** 0.09* 0.73*** -0.24*** 1.00*** -0.75*** 0.46*** 0.51*** 0.26*** -0.27*** 0.60*** -0.38***

DIS -0.38*** 0.66*** -0.71*** -0.10** -0.77*** 0.21*** -0.75*** 1.00*** -0.49*** -0.53*** -0.23*** 0.29*** -0.50*** 0.25***

RAD 0.62*** -0.31*** 0.60*** -0.01 0.61*** -0.21*** 0.46*** -0.49*** 1.00*** 0.91*** 0.46*** -0.44*** 0.49*** -0.38***

TAX 0.58*** -0.31*** 0.72*** -0.04 0.67*** -0.29*** 0.51*** -0.53*** 0.91*** 1.00*** 0.46*** -0.44*** 0.54*** -0.47***

PTRATIO 0.29*** -0.39*** 0.38*** -0.12*** 0.19*** -0.36*** 0.26*** -0.23*** 0.46*** 0.46*** 1.00*** -0.18*** 0.37*** -0.51***

B -0.38*** 0.18*** -0.36*** 0.05 -0.38*** 0.13*** -0.27*** 0.29*** -0.44*** -0.44*** -0.18*** 1.00*** -0.37*** 0.33***

LSTAT 0.45*** -0.41*** 0.60*** -0.05 0.59*** -0.61*** 0.60*** -0.50*** 0.49*** 0.54*** 0.37*** -0.37*** 1.00*** -0.74***

target -0.39*** 0.36*** -0.48*** 0.18*** -0.43*** 0.70*** -0.38*** 0.25*** -0.38*** -0.47*** -0.51*** 0.33*** -0.74*** 1.00***

Heatmap¶

Heatmap of the correlation matrix:

sns.heatmap(corr,

xticklabels=corr.columns,

yticklabels=corr.columns)

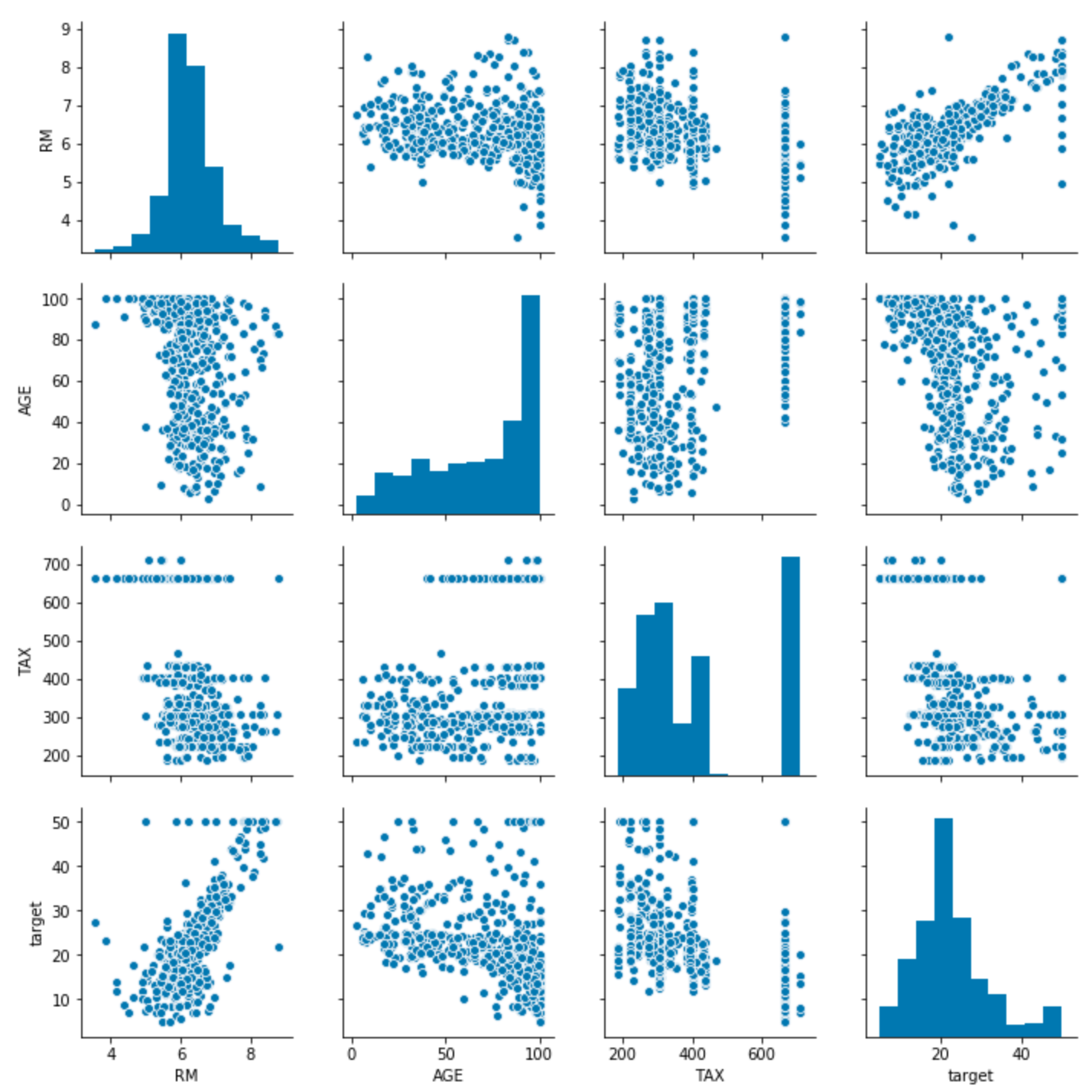

Pairwise distributions with seaborn¶

sns.pairplot(df[['RM', 'AGE', 'TAX', 'target']])

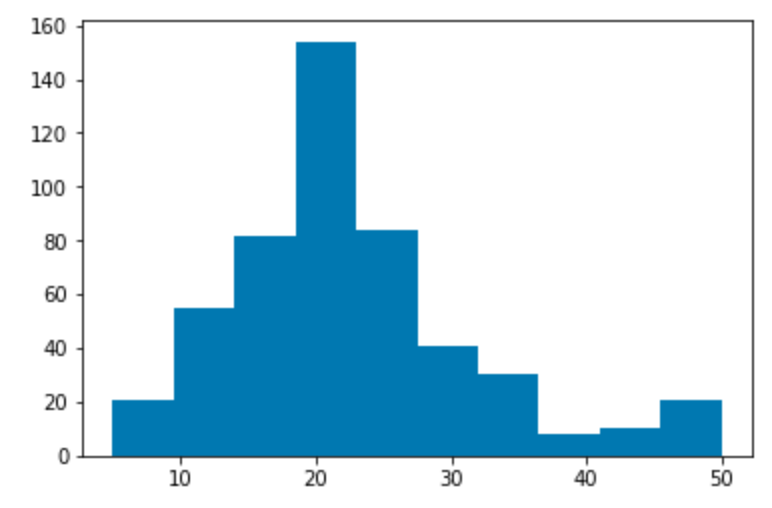

Target variable distribution¶

Histogram showing the distribution of the target variable. In this dataset this is “Median value of owner-occupied homes in $1000’s”, abbreviated MEDV.

plt.hist(df['target'])

plt.show()

Simple linear regression¶

The variable MEDV is the target that the model predicts. All other variables are used as predictors, also called features.

The target variable is continuous, so use a linear regression instead of a logistic regression.

# Define features as X, target as y.

X = df.drop('target', axis='columns')

y = df['target']

Split the dataset into a training set and a test set:

# Splitting the dataset into training set and test set

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.25, random_state = 0)

A linear regression consists of a coefficient for each feature and one intercept.

To make a prediction, each feature is multiplied by its coefficient. The intercept and all of these products are added together. This sum is the predicted value of the target variable.

The residual sum of squares (RSS) is calculated to measure the difference between the prediction and the actual value of the target variable.

The function fit calculates the coefficients and intercept that minimize the

RSS when the regression is used on each record in the training set.

# Fitting Simple Linear Regression to the Training set

from sklearn.linear_model import LinearRegression

regressor = LinearRegression()

regressor.fit(X_train, y_train)

# The intercept

print('Intercept: \n', regressor.intercept_)

# The coefficients

print('Coefficients: \n', pd.Series(regressor.coef_, index=X.columns, name='coefficients'))

Intercept:

36.98045533762056

Coefficients:

CRIM -0.116870

ZN 0.043994

INDUS -0.005348

CHAS 2.394554

NOX -15.629837

RM 3.761455

AGE -0.006950

DIS -1.435205

RAD 0.239756

TAX -0.011294

PTRATIO -0.986626

B 0.008557

LSTAT -0.500029

Name: coefficients, dtype: float64

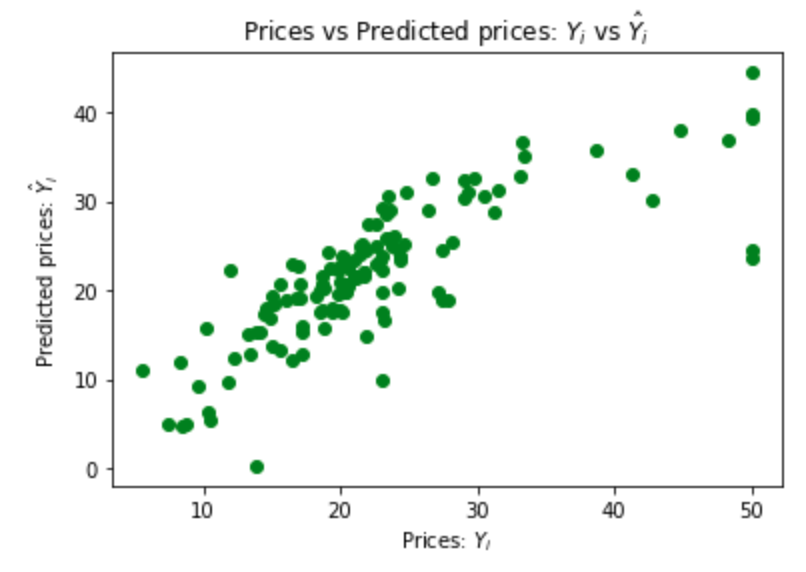

Now check the accuracy when this linear regression is used on new data that it was not trained on. That new data is the test set.

# Predicting the Test set results

y_pred = regressor.predict(X_test)

# Visualising the Test set results

# code adapted from https://joomik.github.io/Housing/

fig, ax = plt.subplots()

ax.scatter(y_test, y_pred, color='green')

ax.set(

xlabel="Prices: $Y_i$",

ylabel="Predicted prices: $\hat{Y}_i$",

title="Prices vs Predicted prices: $Y_i$ vs $\hat{Y}_i$",

)

plt.show()

This scatter plot shows that the regression is a good predictor of the data in the test set.

The mean squared error quantifies this performance:

# The mean squared error as a way to measure model performance.

print("Mean squared error: %.2f" % mean_squared_error(y_test, y_pred))

Mean squared error: 29.79

Ordinary least squares (OLS) regression with Statsmodels¶

model = sm.ols('target ~ AGE + B + CHAS + CRIM + DIS + INDUS + LSTAT + NOX + PTRATIO + RAD + RM + TAX + ZN', df)

result = model.fit()

result.summary()

OLS Regression Results

==============================================================================

Dep. Variable: target R-squared: 0.741

Model: OLS Adj. R-squared: 0.734

Method: Least Squares F-statistic: 108.1

Date: Thu, 23 Aug 2018 Prob (F-statistic): 6.95e-135

Time: 07:29:16 Log-Likelihood: -1498.8

No. Observations: 506 AIC: 3026.

Df Residuals: 492 BIC: 3085.

Df Model: 13

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 36.4911 5.104 7.149 0.000 26.462 46.520

AGE 0.0008 0.013 0.057 0.955 -0.025 0.027

B 0.0094 0.003 3.500 0.001 0.004 0.015

CHAS 2.6886 0.862 3.120 0.002 0.996 4.381

CRIM -0.1072 0.033 -3.276 0.001 -0.171 -0.043

DIS -1.4758 0.199 -7.398 0.000 -1.868 -1.084

INDUS 0.0209 0.061 0.339 0.735 -0.100 0.142

LSTAT -0.5255 0.051 -10.366 0.000 -0.625 -0.426

NOX -17.7958 3.821 -4.658 0.000 -25.302 -10.289

PTRATIO -0.9535 0.131 -7.287 0.000 -1.211 -0.696

RAD 0.3057 0.066 4.608 0.000 0.175 0.436

RM 3.8048 0.418 9.102 0.000 2.983 4.626

TAX -0.0123 0.004 -3.278 0.001 -0.020 -0.005

ZN 0.0464 0.014 3.380 0.001 0.019 0.073

==============================================================================

Omnibus: 178.029 Durbin-Watson: 1.078

Prob(Omnibus): 0.000 Jarque-Bera (JB): 782.015

Skew: 1.521 Prob(JB): 1.54e-170

Kurtosis: 8.276 Cond. No. 1.51e+04

==============================================================================

Warnings:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.51e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

Principal component analysis¶

The initial dataset has a number of feature or predictor variables and one target variable to predict.

Principal component analysis (PCA) converts these features into a set of principal components, which are linearly uncorrelated variables.

The first principal component has the largest possible variance and therefore accounts for as much of the variability in the data as possible.

Each of the other principal components is orthogonal to all of its preceding components, but has the largest possible variance within that constraint.

Graphing a dataset by showing only the first two or three of the principal components effectively projects a complex dataset with high dimensionality into a simpler image that shows as much of the variance in the data as possible.

PCA is sensitive to the relative scaling of the original variables, so begin by scaling them:

# Feature Scaling

x = StandardScaler().fit_transform(X)

Calculate the first three principal components and show them for the first five rows of the housing dataset:

# Project data to 3 dimensions

pca = PCA(n_components=3)

principalComponents = pca.fit_transform(x)

principalDf = pd.DataFrame(

data = principalComponents,

columns = ['principal component 1', 'principal component 2', 'principal component 3'])

principalDf.head()

row |

principal component 1 |

principal component 2 |

principal component 3 |

|---|---|---|---|

0 |

-2.097842 |

0.777102 |

0.335076 |

1 |

-1.456412 |

0.588088 |

-0.701340 |

2 |

-2.074152 |

0.602185 |

0.161234 |

3 |

-2.611332 |

-0.005981 |

-0.101940 |

4 |

-2.457972 |

0.098860 |

-0.077893 |

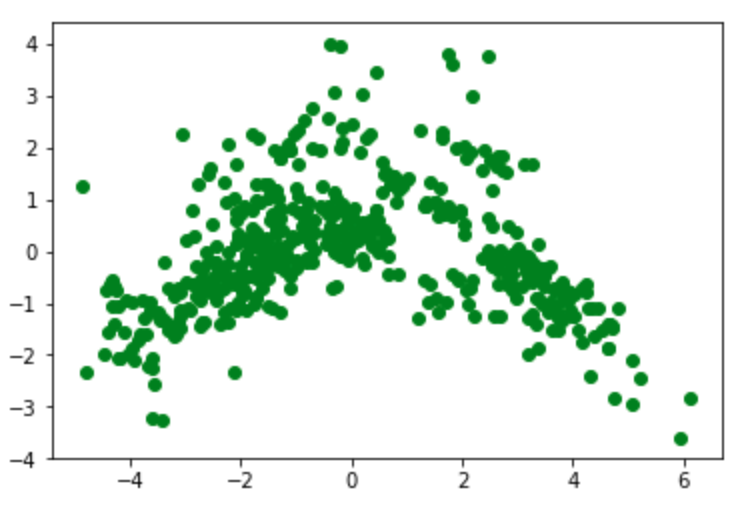

Show a 2D graph of this data:

plt.scatter(principalDf['principal component 1'], principalDf['principal component 2'], color ='green')

plt.show()

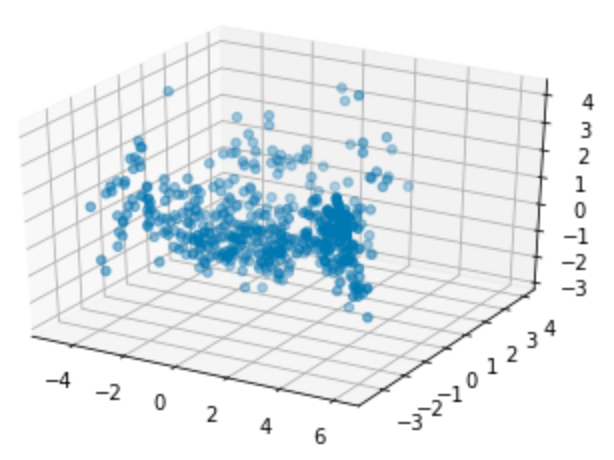

Show a 3D graph of this data:

fig = plt.figure()

ax = fig.add_subplot(111, projection='3d')

ax.scatter(principalDf['principal component 1'], principalDf['principal component 2'], principalDf['principal component 3'])

plt.show()

Measure how much of the variance is explained by each of the three components:

# Variance explained by each component

explained_variance = pca.explained_variance_ratio_

explained_variance

array([0.47097344, 0.11015872, 0.09547408])

Each value will be less than or equal to the previous value, and each value will be in the range from 0 through 1.

The sum of these three values shows the fraction of the total variance explained by the three principal components, in the range from 0 (none) through 1 (all):

sum(explained_variance)

0.6766062376563704

Predict the target variable using only the three principal components:

y_test_linear = y_test

y_pred_linear = y_pred

X = principalDf

y = df['target']

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size = 0.25, random_state = 0)

regressor = LinearRegression()

regressor.fit(X_train, y_train)

y_pred = regressor.predict(X_test)

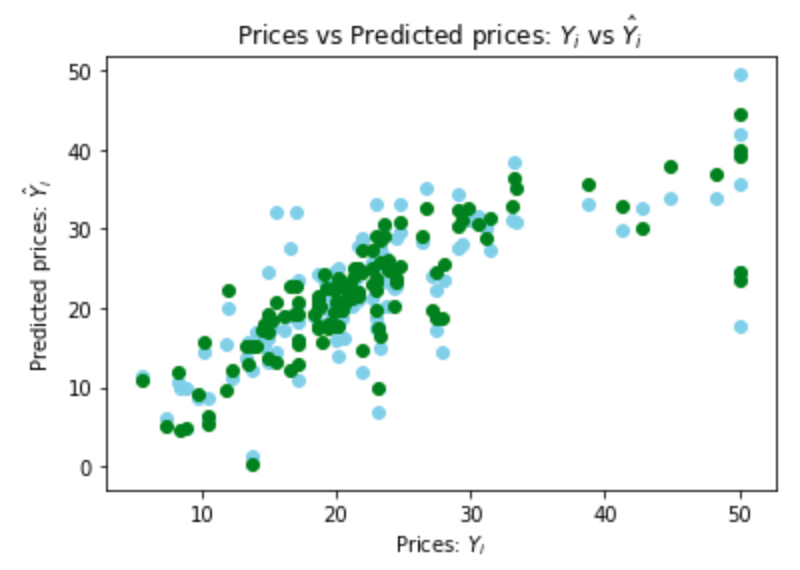

Plot the predictions from the linear regression in green again, and the new predictions in blue:

fig, ax = plt.subplots()

ax.scatter(y_test, y_pred, color='skyblue')

ax.scatter(y_test_linear, y_pred_linear, color = 'green')

ax.set(

xlabel="Prices: $Y_i$",

ylabel="Predicted prices: $\hat{Y}_i$",

title="Prices vs Predicted prices: $Y_i$ vs $\hat{Y}_i$",

)

plt.show()

The blue points are somewhat more widely scattered, but similar.

Calculate the mean squared error:

print("Linear regression mean squared error: %.2f" % mean_squared_error(y_test_linear, y_pred_linear))

print("PCA mean squared error: %.2f" % mean_squared_error(y_test, y_pred))

Linear regression mean squared error: 29.79

PCA mean squared error: 43.49